Huawei still leads the telecoms kit market despite US sanctions

Despite being impacted by the US sanctions, Chinese vendor Huawei remains the market leader for telecoms equipment globally according to market analysis from Dell’Oro Group.

March 15, 2022

Despite being impacted by the US sanctions, Chinese vendor Huawei remains the market leader for telecoms equipment globally according to market analysis from Dell’Oro Group.

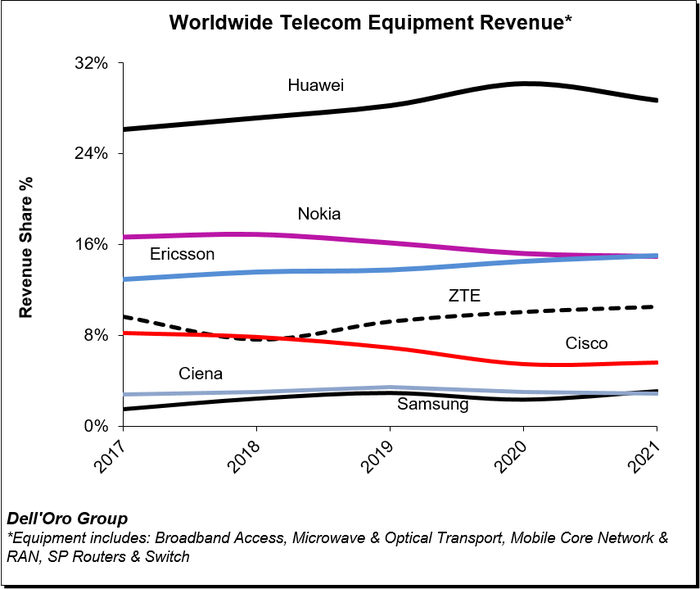

The telecom equipment market grew by 7% in 2021, representing a fourth consecutive year of growth driven by ‘surging wireless revenues’, wireline-related equipment demand, and double-digit growth both for RAN and Broadband Access, claims Dell’Oro. The firm has added up the whole market and reckons revenues approached $100 billion last year, up over 20% since 2017.

The US campaign to ban the use of Huawei telecoms kit in its and its allies’ territories has had an impact, but apparently not enough of one to dislodge the Chinese manufacturer from its number one spot globally in terms of revenue share. Dell’Oro calculates that Huawei represents 28.7% of global revenue share, followed by Ericsson (15%), Nokia (14.9%), ZTE (10.5%), Cisco (5.6%), Samsung (3.1%), and Ciena (2.9%)

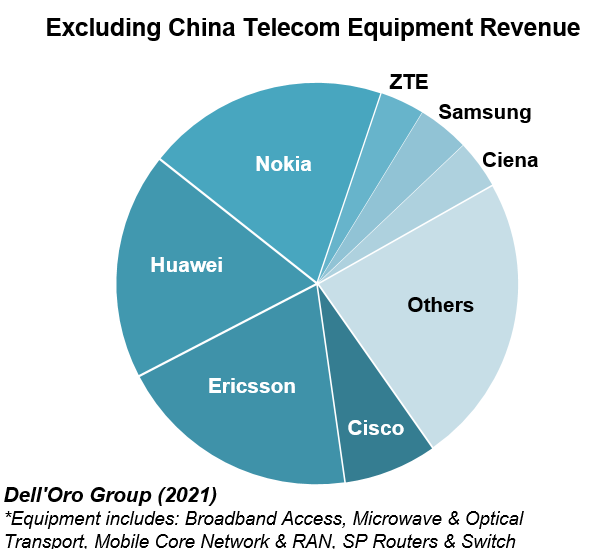

Excluding the Chinese market the competition between the big three kit vendors is more even, with Ericsson and Nokia at 20% and Huawei at around 18% of the market.

In terms of future forecasting, the report claims: “The relative growth rates have been revised upward for 2022 to reflect new supply chain and capex data. Still, global telecom equipment growth is expected to moderate from 7% in 2021 to 4% in 2022. Risks are broadly balanced. In addition to the direct and indirect impact of the war in Ukraine and the broader implications across Europe and the world, the industry is still contending with COVID-19 restrictions and supply chain disruptions. At the same time, wireless capex is expected to surge in the US this year.”

The US sanctions against Huawei might not have knocked them off the top spot, but cross referencing with last year’s report from Dell’Oro, its lead has been thinned somewhat. In 2020, the analyst claimed Huawei had a 31% revenue share in the kit market – more than twice that of its closest rival Nokia, which accounted for 15% of the market. Dropping to 28.7% of the global revenue share for 2021 might not seem huge but it represents a huge amount of money, and at that trajectory we could see some more significant changes in terms of market share by the time the figures for 2022 emerge – assuming sanctions stay in place.

About the Author

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)

_1.jpg?width=300&auto=webp&quality=80&disable=upscale)